Contributed by PB Tam.

Disclaimer: Information presented holds no warranty and is written based on personal research.

Thinking about installing solar panels? Read this first!

Solar panel informational how-to for Milton Neighbors

Recently, it has become increasingly easy for home owners to purchase solar panels for their home and with the many incentive programs available in Massachusetts, it is becoming a great opportunity to install a solar energy system. The appeal of a solar energy system is the ultimate goal of cost- free electricity.

There are two primary models for solar energy systems:

PPA Model – Solar City (Power Purchase Agreement)

The first is to lease the system with companies such as Solar City. Their business model is they will pay for the equipment and all the costs in exchange for allowing them to put the panels on your home with a 15-20 year agreement. This model is good for some, but with this system, the homeowner will forfeit the many incentives currently available. Rumors about how solar panels can stop a home sale is based on this model and the long-term agreement in which the homeowner enters.

Purchase of the panels

The better option is to purchase a solar energy system. Most people think it is an expensive purchase but with the myriad incentives and programs set by the state of Massachusetts, it can be a cost-effective option.

The goal is to create a system that would cover 100% of the electricity used by the homeowner. This is determined by looking at the back of your electricity bill and adding up the previous 12 months usage. A smaller home may use 5,000 kwh or a larger house, up to 10,000+ kwh. With the current rate of $0.215 per kwh, the energy savings per year can be easily $1,000+.

On top of energy savings, there are other opportunities that make purchasing so appealing:

Financing

Home owners can take advantage of the Mass Solar Loans financing program. Currently, Bank of Weymouth is offering a very appealing program with the rate of 1.25% over 10 years. On a $20,000 loan it’s an average of $11 of interest per month. (Loan closing cost of 1% of loan)

Federal Tax Credit

30% of the purchase price can be subtracted from the homeowner’s federal taxes. In the example of a $20,000 system, $6,000 can be deducted from federal taxes. With this savings, the loan can be paid down from a $20,000 balance to a $14,000 balance.

(SAVINGS: $6,000)

State Tax Credit

The state of Massachusetts also incentivizes home owners with a $1,000 tax credit from their state taxes. This will also apply to the balance of the loan.

(SAVINGS: $1,000)

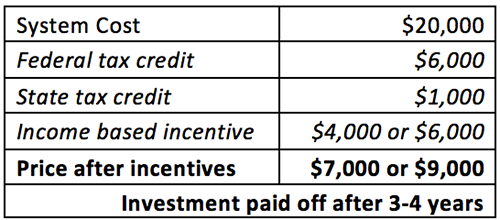

Income Based Incentive (Income qualification)

The state of Massachusetts also helps low-income households with the cost of ownership with a 20% – 30% buy down depending on the household income. This becomes an additional $5,000 – $7,500 savings on the system price.

(POTENTIAL SAVINGS: $4,000 – $6,000)

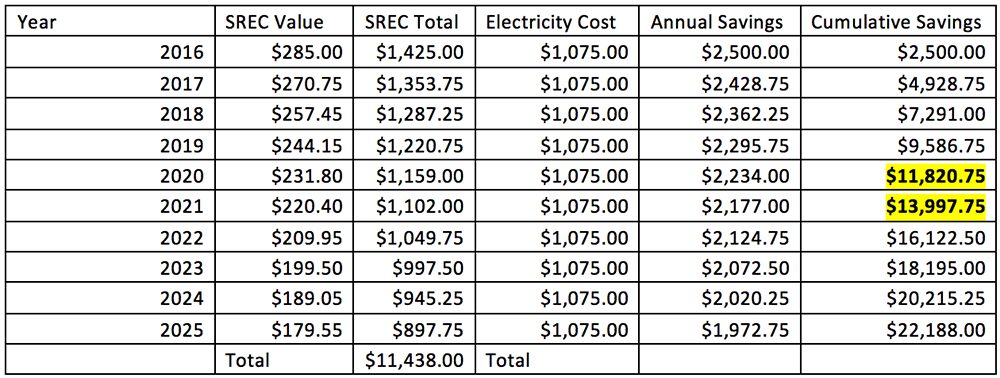

SREC II Program

This is an incentive program created by the state of Massachusetts to promote the growth of solar energy. For every 1000 kwh generated by a solar energy system, the owner accumulates 1 SREC credit. This can be sold in 2016 for $285. This program is available for 10 years with the value of SREC credits decreasing 5% each year. The SREC credits are purchased by energy companies that otherwise would have to pay more than $285 for each energy credit they are short from state governed minimums. With a system that generates 5,000 kwh, 5 SREC credits are accumulated, which can be sold for $1,425 in 2016.

Over a 10 year span, SREC credit income will be over $11,000.

NOTE: SREC income is not considered taxable income. It is tax free income.

“According to one SREC aggregator’s contact with the IRS, the proceeds of SRECs should be considered an offset to the purchase of the solar energy system, and are therefore not taxable. The IRS also stated that the sale of SRECs does not fit within the transaction types that would initiate the generation of a 1099. If you are uncertain, please contact a tax professional.”

Source – www.masssolarinfo.com/Massachusetts-SRECs.aspx

NOTE: The SREC II program is scheduled to end around the end of 2016. Time is a factor to qualify for this incentive. Please consult with the solar company to see if your install will be in time to qualify

Savings Summary

Solar savings summary

(Full schedule of SREC Value and details here:

www.mass.gov/eea/energy-utilities-clean-tech/renewable-energy/solar/rps-solar-carve-out-2/current-statis-solar-carve-out-ii.html)

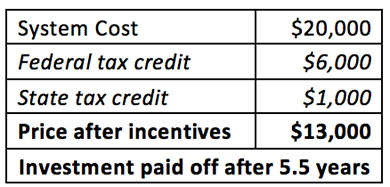

Cost Summary (Hypothetical)

- Solar panel system cost estimate

- Solar panel system cost estimate

Monthly payment on a $20,000 loan: $177.39

Monthly payment after prepaying $7,000 from federal and state tax credit savings: $110.00

(Source: www.bankrate.com/

FAQ:

1. What is net metering?

When a solar energy system generates more energy than the amount used, the excess energy goes back through the power lines and is supplied to the electricity company. When this occurs, a special meter installed at the home will spin backwards and will give you a credit on your bill for the excess kwh generated. During the summer months most homes will generate excess energy. This is then used to compensate for winter months when solar energy production is generally less than the amount used.

2. What if the tax credit exceeds my tax liability? Will I get a refund?

This is a non-refundable tax credit, meaning you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. However, you can carryover any unused amount of tax credit to the next tax year.

3. When will I pay this off?

After about five years, the total investment will have paid itself off. For those who qualify for the income based incentive, this can be as soon as three years. SREC income accrued up to year ten is tax-free income.

4. After I fully pay for my system, what will my electricity cost?

Energy produced after the system is paid off is cost-free electricity.

5. Will my savings be exponential?

The cost of electricity is in an upwards trend. The savings summary graph assumes the cost of electricity is static at the current rate of $0.215/kwh. Savings from energy will most likely be much greater.

6. My roof is 20 years old. What does this mean for a solar system?

A healthy roof is essential. An older roof may need to be repaired or replaced. For roof replacements, the cost of the roof used to support the solar panels may apply for the 30% federal tax credit (consult your accountant).

7. What about warranties?

- Solar panels are manufacture warrantied for 25 years for production. They production after 25 years will be 80% or more of original production. Panels are also manufacture warrantied for 10 years for workmanship and materials.

- Labor warranties from install companies are generally 10 years. This includes removal and replacement of panels.

8. Are there any hidden or additional costs?

Total cost will depend on many factors including:

- Roof condition

- Roof orientation

- Energy usage

- System size, etc.

An essential part of the solar energy system is the power optimizer. It is a $2,000 part that has a life expectancy of 12 years. It is to be an expected cost after 12 years. It may become cheaper as the technology matures.

9. Do you have any additional savings suggestions?

The author was told that instead of paying off the system with the federal and state tax credit, owners should apply the savings to their mortgage, so an owner will end up paying 1.25% interest rather than the interest rate of the mortgage.

10. I’m going for it! What are my next steps and how long will it take?

See below for our recommended company. This company is approximately $2,000 less than the closest competitor.

Installation timeline is about 2 months due to engineering design, financing, permitting, etc.

Be the first to comment on "How to go solar: a detailed guide for homeowners"